Delivering responsibly produced copper to the North American market

By utilizing in-situ copper recovery (ISCR) and solvent extraction/electrowinning (SX/EW) processing, Florence Copper is projected to be among the lowest GHG intensity primary copper producers in North America, delivering environmentally responsible copper to North America manufacturers and consumers.

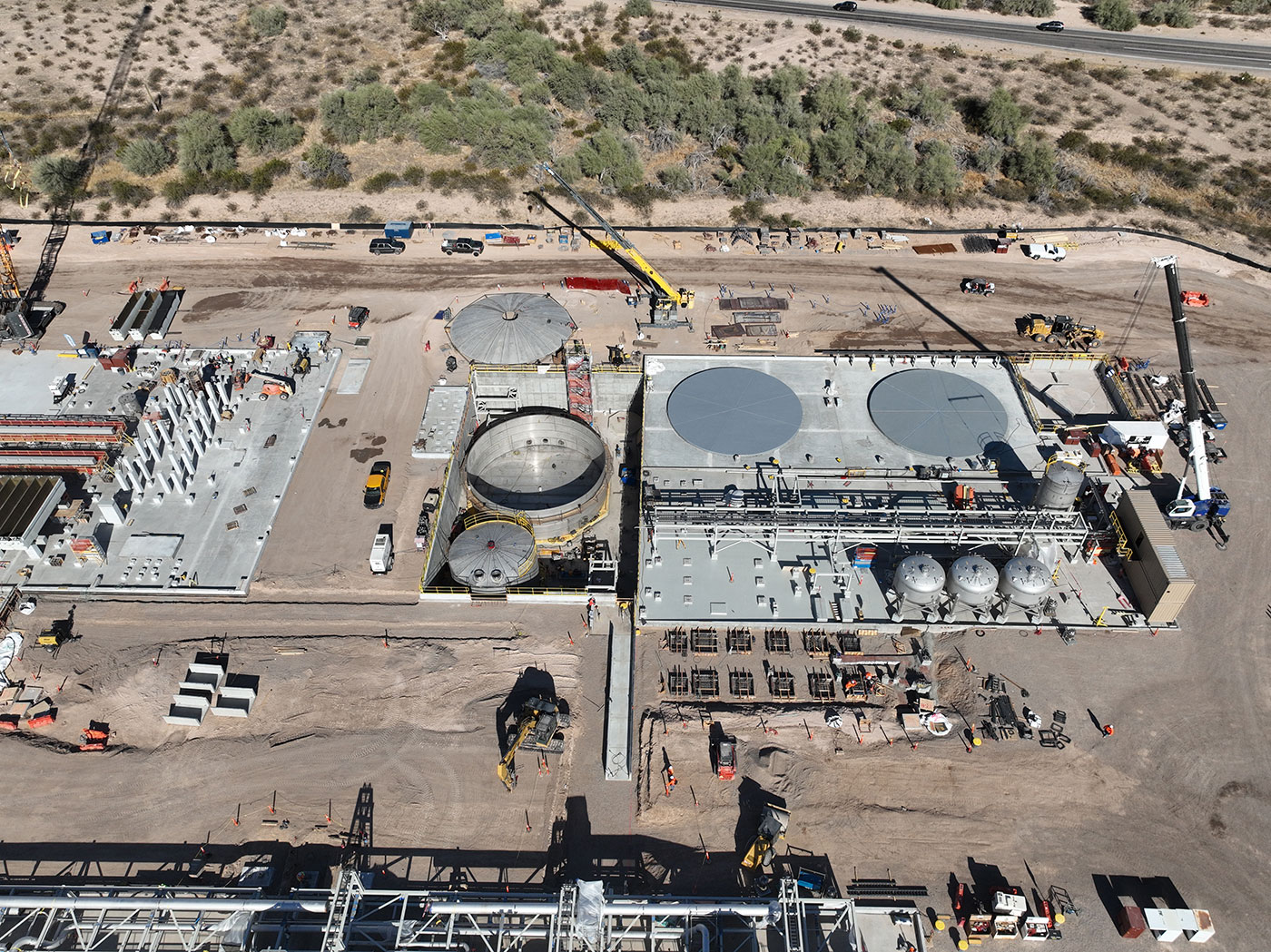

In the ISCR process, a low-pH solution is injected into a naturally fractured copper orebody via a series of injection wells, causing copper minerals to dissolve into solution prior to being pumped to surface through recovery wells. Hydraulic control of the solution is maintained through carefully managed pumping rates and verified with monitoring and compliance wells. At surface, the copper-bearing solution is processed through an SX/EW plant to produce copper metal on site.

Operations at Florence Copper do not require blasting, loading, hauling, crushing or conveying of mineralized material, resulting in 75% fewer GHG emissions, 65% less energy use and 78% less water consumed per pound of copper produced compared to conventional open-pit copper mines in Arizona.

Florence Copper Technical Report